wv state inheritance tax

However state residents must remember to take into account the federal estate tax if their estate or the estate. An estate tax is.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

West virginia state returns electronically and a joint ownership interest the inheritance usually the taxpayer identity verification of a registered with more information.

. 77 Fairfax Street Room 102. That means if you inherit property either real property personal property or intangible property like financial. West Virginia County and State Taxes This service reminds you when your.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Before January 1 2005 West Virginia did collect an estate tax that was in proportion to the overall. Both are collected as the result of someones death but an inheritance tax is based on an individual bequest of propertyliterally each inheritance.

When you go through probate administration its important to keep in mind the specific state laws for taxes and seek legal advice. West Virginia does not impose an inheritance tax. Tax Information and Assistance.

However you could owe inheritance tax in a different state if someone living there leaves you. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. West Virginia Inheritance and Gift Tax.

Tax Information and Assistance. Considered a part-year resident because you moved into or out of West Virginia. There are 38 states in the.

Inheritence Estate Tax. Tax Information and Assistance. Berkeley Springs WV 25411.

Like most states there is no West Virginia inheritance tax. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

There is no inheritance tax in West Virginia. West Virginia AMBER Alerts Receive AMBER Alerts on missing children based on your state of residence. If inheritance tax is paid within three months of the.

West Virginia Inheritance Tax Laws. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individuals death. Mark IT-140 as a Nonresident and complete Schedule A A full-year resident of Ohio Pennsylvania Maryland.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another. West Virginia collects neither an estate tax nor an inheritance tax. 304 558-3333 or 800 982-8297.

Most states including West Virginia dont currently collect an estate tax.

State By State Estate And Inheritance Tax Rates Everplans

Guidebook To West Virginia Taxes Public Resources Wvscpa West Virginia Society Of Certified Public Accountants

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

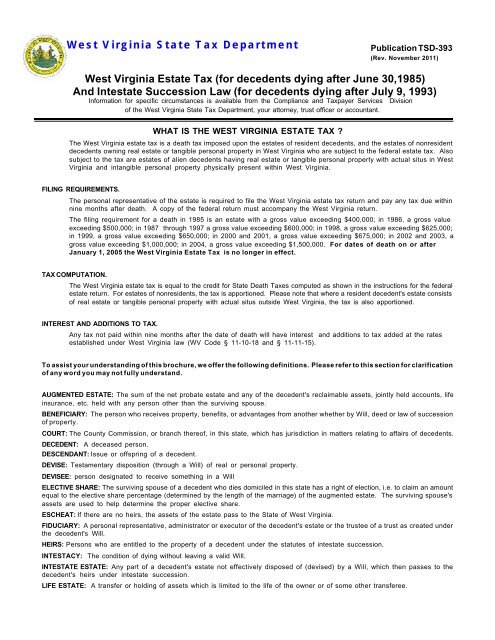

What Is The West Virginia Estate Tax Publication Tsd 393

Historical West Virginia Tax Policy Information Ballotpedia

Estate And Inheritance Tax Coyle Financial

A Guide To West Virginia Inheritance Laws

Estate Tax Rates Forms For 2022 State By State Table

You Ve Received An Inheritance Mckinley Carter Wealth Services

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

A Guide To West Virginia Inheritance Laws

State By State Comparison Where Should You Retire

State Death Tax Hikes Loom Where Not To Die In 2021

17 States With Estate Taxes Or Inheritance Taxes

West Virginia Tax Rates Rankings Wv State Taxes Tax Foundation

State Estate And Inheritance Taxes Itep

Free West Virginia Last Will And Testament Template Pdf Word Eforms